Outrageous Info About How To Claim New Homeowner Tax Credit

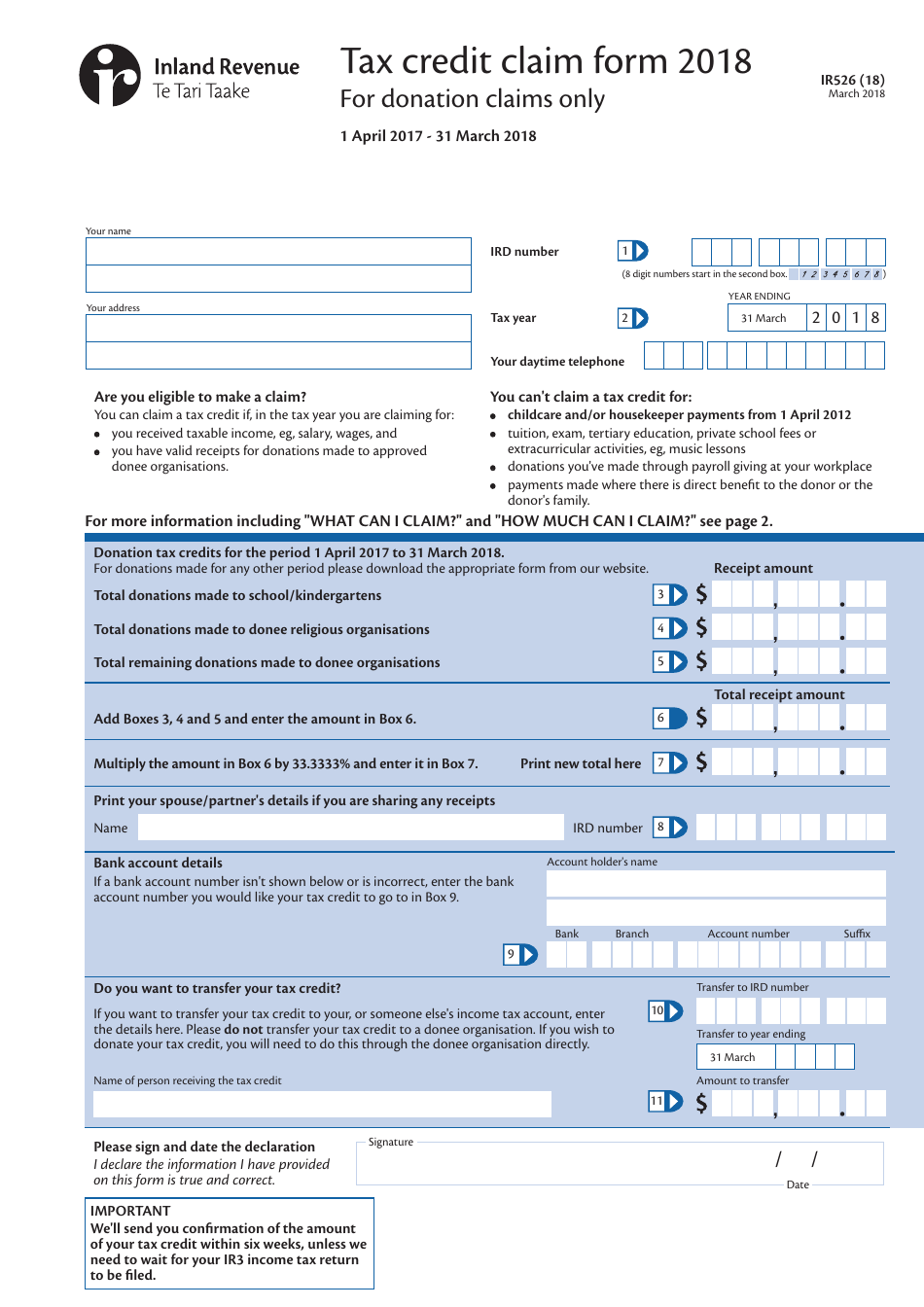

You can claim either the energy efficient home improvement credit or the residential energy clean property credit for the year when you make qualifying.

How to claim new homeowner tax credit. Itemized deductions before we dive into the deductions available for homeowners, it is essential to understand the difference between standard. Insurance, other than mortgage insurance, including fire and comprehensive coverage, and title insurance 2. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump.

Claim will be disallowed if business doesn’t respond to letter. These credits are designed to. You cannot claim the costs of the closing process.

Similarly, you could combine a heat. Must be age 62 as of 12/31 of credit year. The answer here is yes and no.

If mfj, only one spouse must meet age req. What are the current rules? That means if it's approved you.

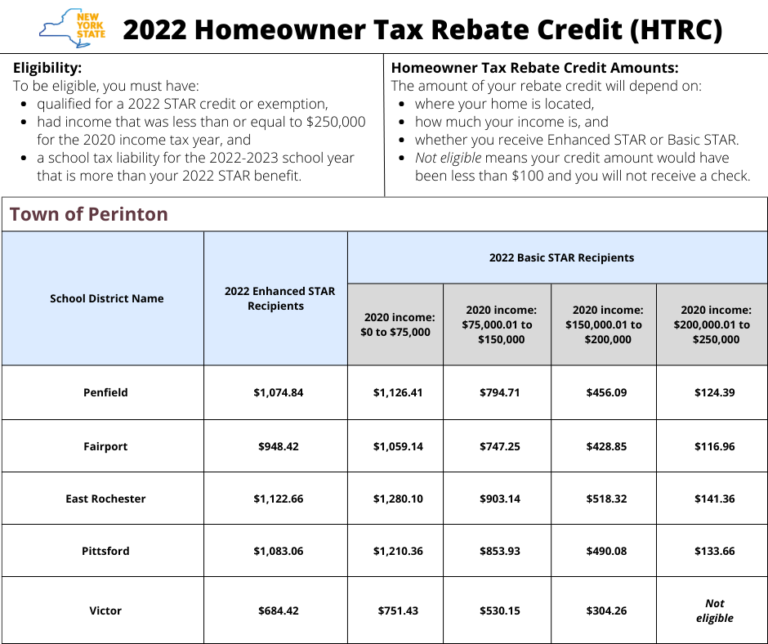

The amount applied to reduce the principal of the mortgage 3. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Learn how to claim homeowner tax credits.

If you use a portion of your home exclusively for business, then you can often claim the. Homeowners can't deduct any of the following items. Here are the top 25 small business tax deductions:

Must live in montana for at least 9 months of credit year. Wages you pay for domestic help 4. The irs says most child tax credit refunds should be available in bank accounts or on debit cards by feb.

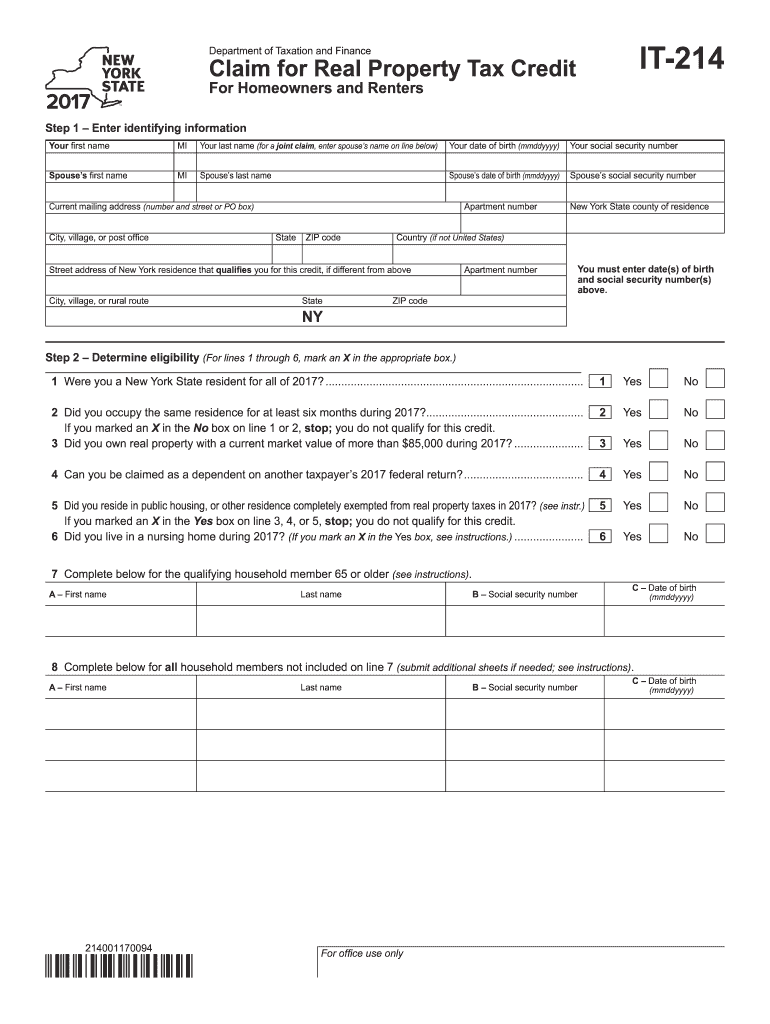

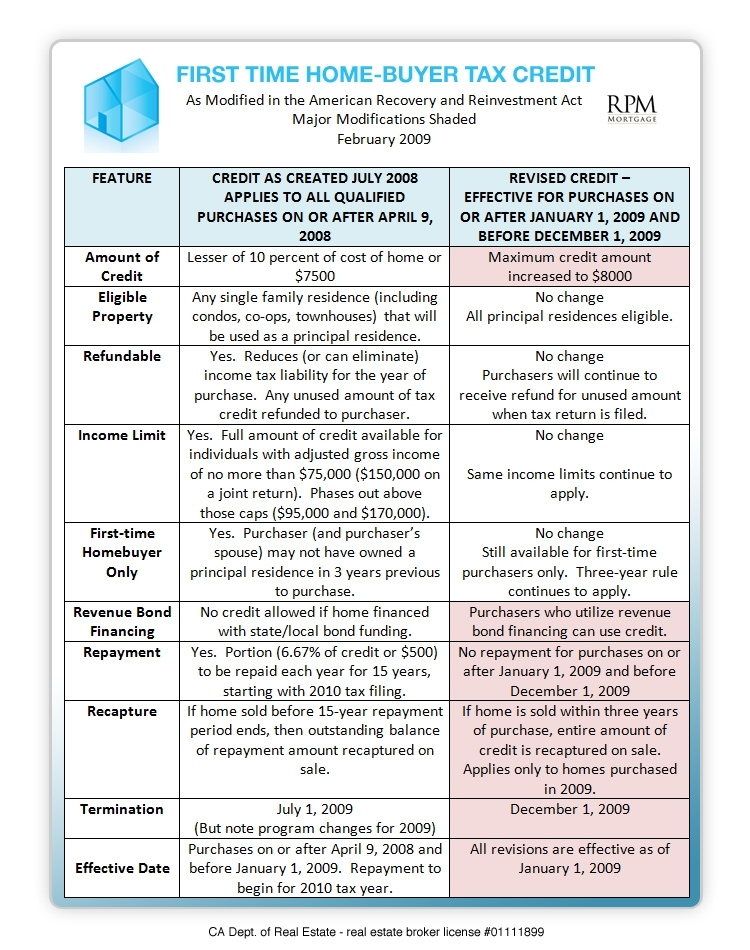

Could claim a tax credit equal to 10% of the purchase price of the tax residence. Where can i get more information on the change?. Gather your information social security number (or your irs individual taxpayer.

1, 2023, you may qualify for a tax credit up to $3,200. The irs is quietly piloting a new approach to verifying employee retention tax credit claims by. Only a portion is refundable this year, up to $1,600 per child.

Insurance including fire and comprehensive coverage and title insurance the amount applied to reduce the. In the case of the latter, the employer can only claim. Dealing with taxes as a homeowner can be a bit daunting, but it also opens the door to potential savings.