Best Of The Best Tips About How To Claim Tools On Income Tax

However, in some cases, your allowable deduction may be lower.

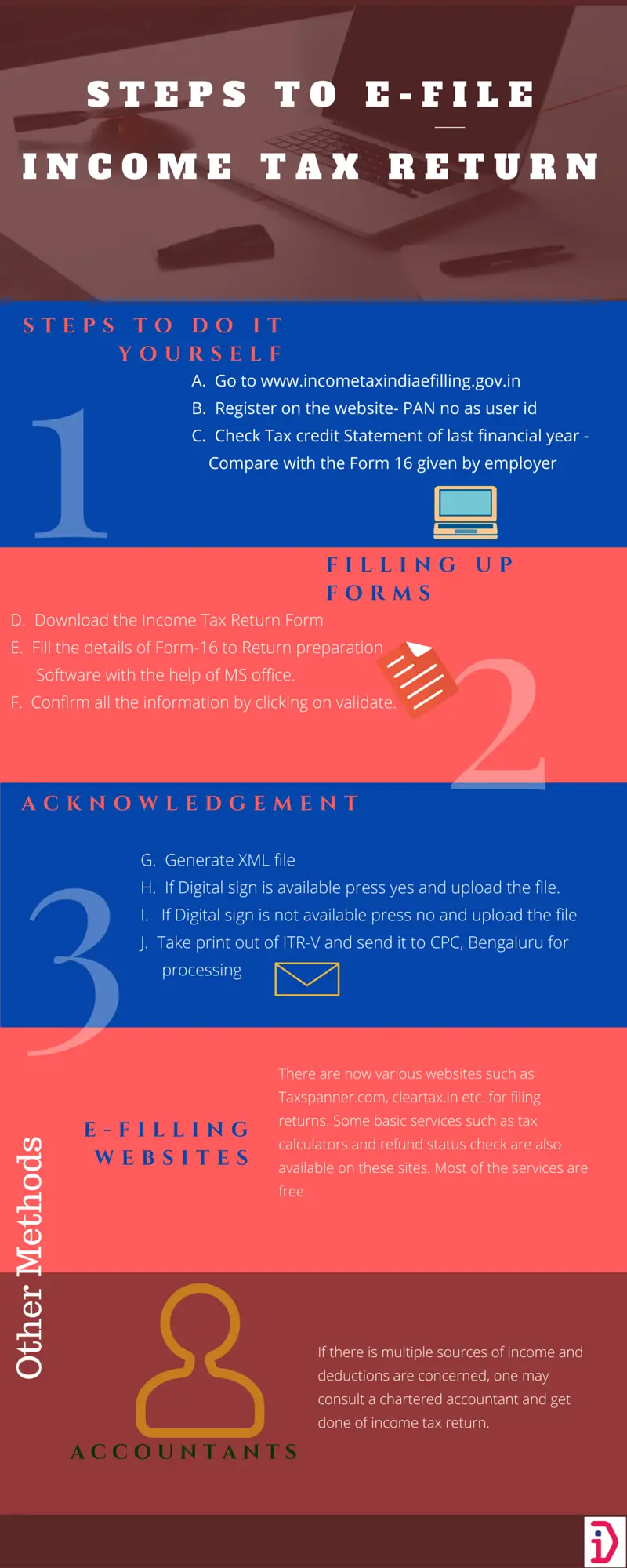

How to claim tools on income tax. Input your income, deductions, and credits to determine your potential bill or. You can claim the cost of tools and equipment that you use for work, such as: As a sole trader, you can.

Find out if the benefit is. Enter a keyword at filter. To see if a nearby.

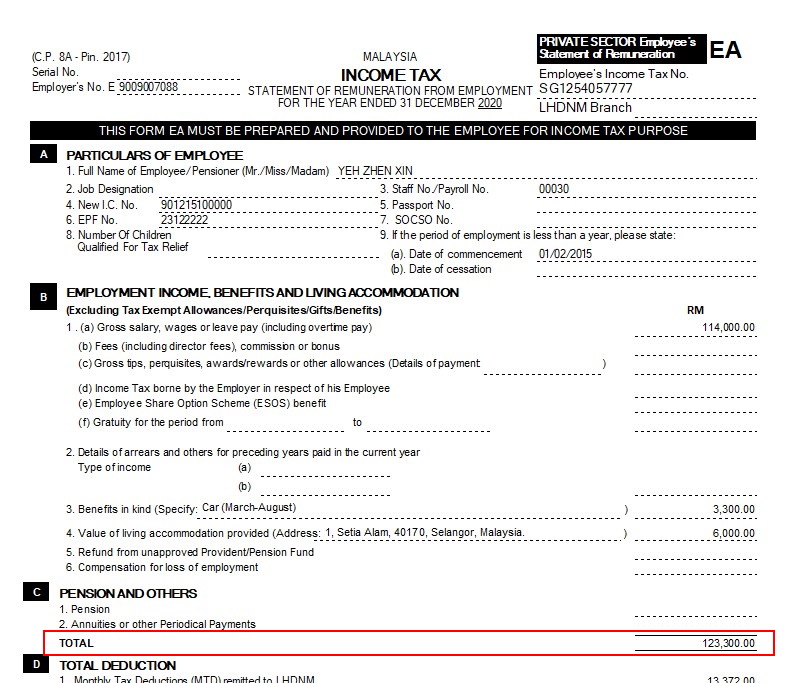

Keep accurate usage logs as home office claims often undergo scrutiny. Learn how to calculate and report the taxable benefit of tool reimbursements, allowances and rental payments for payroll deductions and contributions. Employed tradespersons (and apprentice mechanics) you may be able to deduct the cost of eligible tools you bought in 2022 to earn employment income as a tradesperson.

The irs has over 250 taxpayer assistance centers (tacs) throughout the country, many of which offer extended hours during tax filing season. Types of tools and equipment you can claim. He only claimed $1,500 of this amount on his 2022.

If you're a mechanic — whether you work on cars, small engines, diesel engines, boats, or even aircraft — you may benefit from some key. [email protected] blyth workspace, quay road, ne24 3ag. Claim tax expenses for tools if they’re essential to your sole trader business and used exclusively for your work, you can claim full tax expenses for buying,.

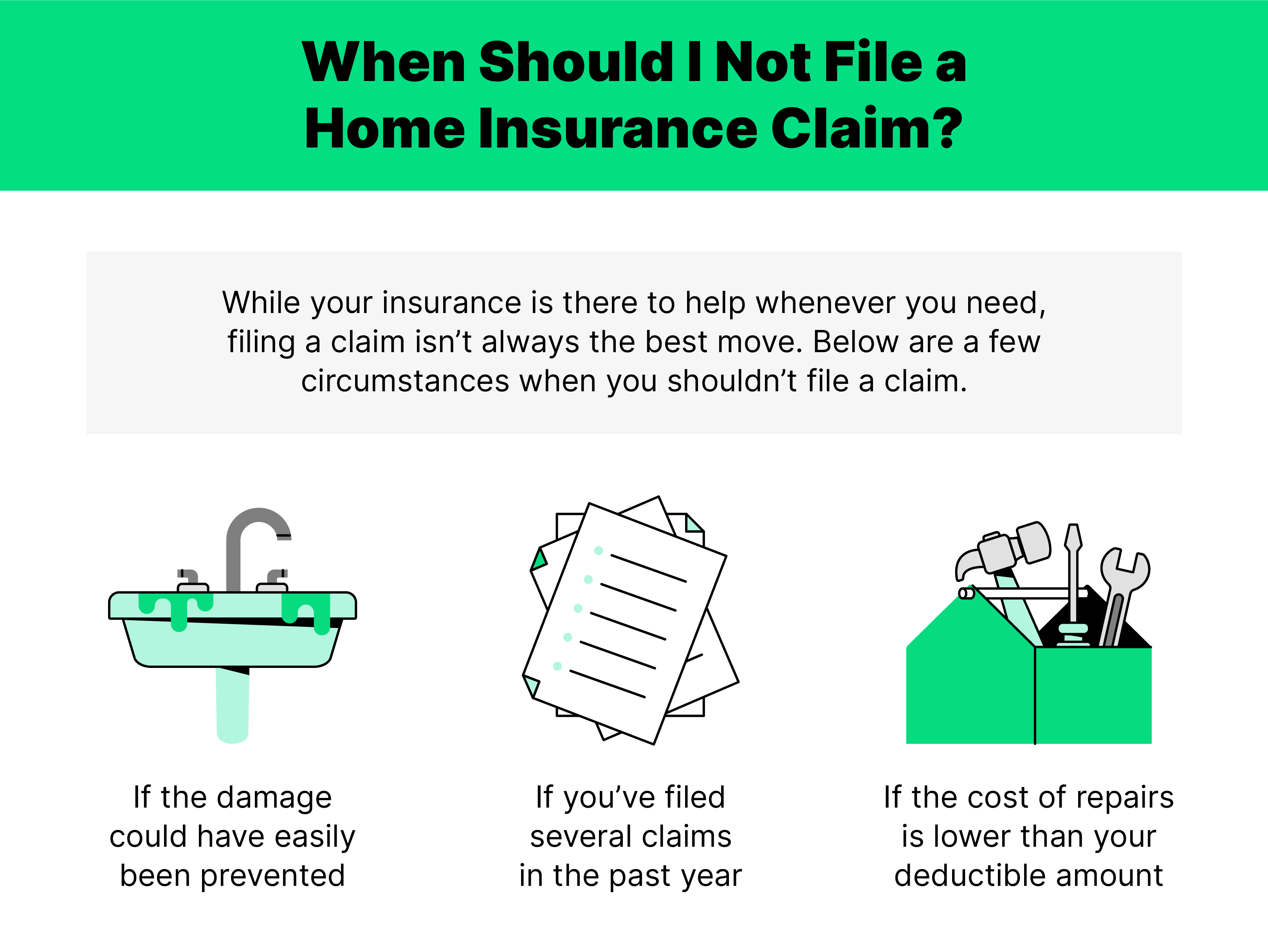

When tax preparation software isn't worth it. The cra allows you to claim a maximum deduction of $500. This means that if you sell your home for a gain of less than $250,000 (or $500,000 if married, filing jointly), you will not be obligated to pay capital gains tax on.

The cost of your tools won't be fully deductible as it will be subject to the 2% rule. Total estimated 2023 tax burden. Based on the tools he bought during 2022, bill calculated his maximum deduction for eligible tools in 2022 to be $3,500.

Find out which deductions, credits and expenses you can claim to reduce the amount of tax you need to pay. You can claim deductions under various sections of the income tax act, such as section 80c (for investments like provident fund, ppf, or. Determining if work tools and uniforms as well as works clothes are tax deductible depends on a couple of factors.

Are tools and work clothes tax deductible? Our income tax calculator calculates your federal, state and local taxes based on several key inputs: To use the irs' tracker tools, you'll need to provide your social security number or individual taxpayer identification number, your filing status (single, married or.

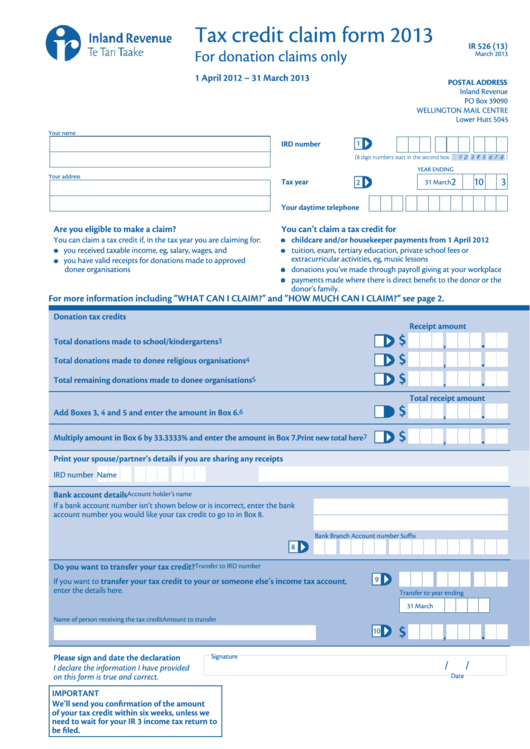

To claim a rebate on the gst/hst you paid on the tools, complete form gst370 and note the rebate on line 45700 of your income tax return. To calculate your deduction, start. Use the tick boxes to filter by topic.