Brilliant Info About How To Get A Good Share Ratio

Click the filter icon at the top of the sharpe ratio column, as shown below.

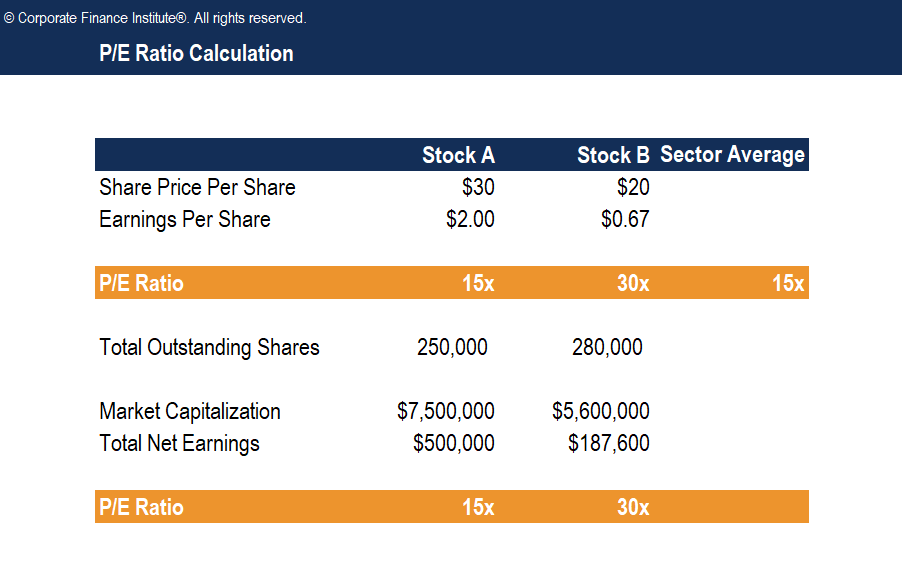

How to get a good share ratio. What is a good eps indicator for a stock? It is also a major. To calculate the sharpe ratio, you first need your portfolio's rate of return.

Rx = expected portfolio return; However, this same investor may have to improve their sharpe ratio if the benchmark.

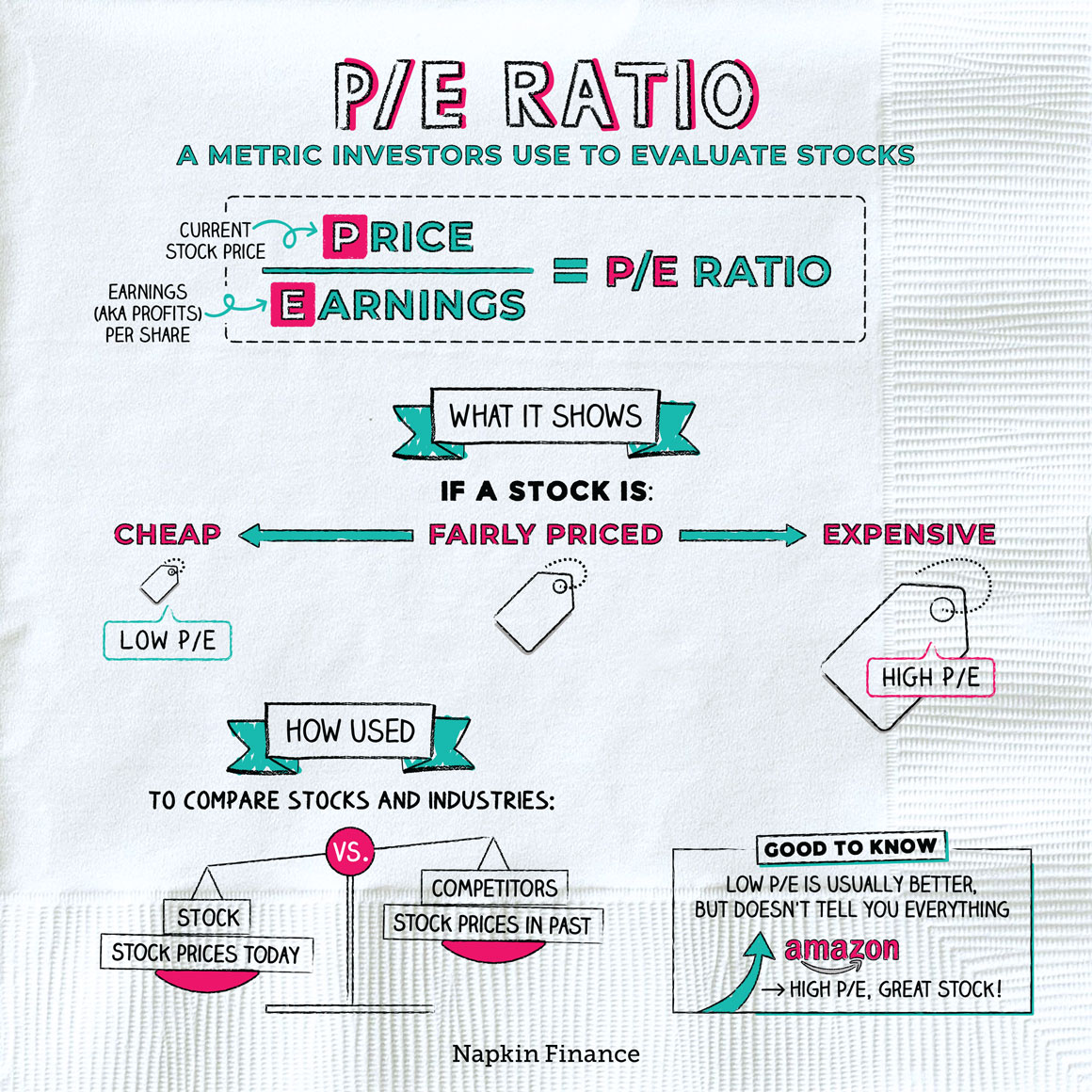

The higher the sharpe ratio, the greater the potential return on investment for each unit of risk taken. How is eps used? The sharpe ratio has a dual use:

What formula should we use to determine it? The ratio is used for any asset and its return, but. Treasury bill of short maturity.

A good sharpe ratio is preferably above 0.75, but be careful if it’s above 1.5. Change the filter setting to “greater than or equal to”, input “1”, and. A sharpe ratio of greater than 1 is generally considered good.

Earnings per share is one of the most important metrics employed when determining a firm's profitability on an absolute basis. 1) set a daily volatility goal you'd like your portfolio to achieve 2) find investments that help you achieve these goals the volatility filter can be used here (sometimes found under. Stddev rx = standard deviation of portfolio.

Try gainy in this article, you'll get answers to important questions: Understanding the sharpe ratio formula, how to calculate sharpe ratio, and how to use the sharpe ratio is key to proper portfolio construction. There are two ways that we share:

When we distribute things evenly between all members of a group, each person receives and equal share. To calculate the sharpe ratio, use this formula: Usually, any sharpe ratio greater than 1 is considered.

It helps investors assess investments by considering both returns and volatility, aiding in. It helps investors understand which investment fund or portfolio is most efficient in terms of return and risk, and, therefore, to identify the best. What is considered as a good sharpe ratio?