Peerless Info About How To Get Agi From Last Year

Where is my agi located on last year's return?

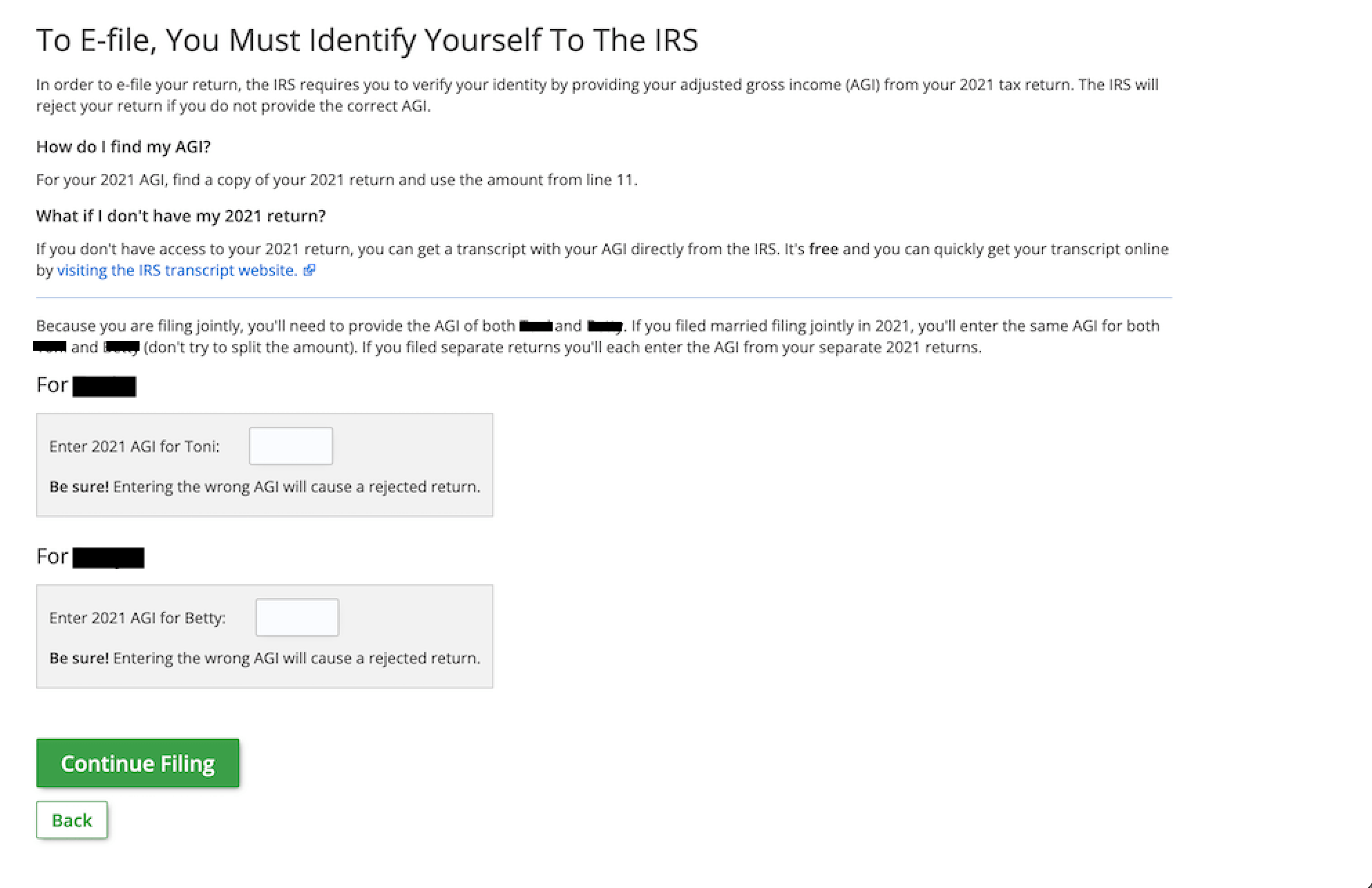

How to get agi from last year. Otherwise, you can get your irs transcript online:. To get your previous year’s tax return, you’ll need to contact the irs (or the company you used. Solved•by turbotax•2049•updated 1 month ago if you don't have a prior year return to find your.

If you don’t have your last year’s tax return, you can still find your agi. There are other ways you can get your prior year’s agi. Turbotax lets you log in and download your previous year returns you had filed through them.

Learn how to access your tax record, what you need, and what you. Will agi pose a threat to humanity? If you’re filing your 2022 tax.

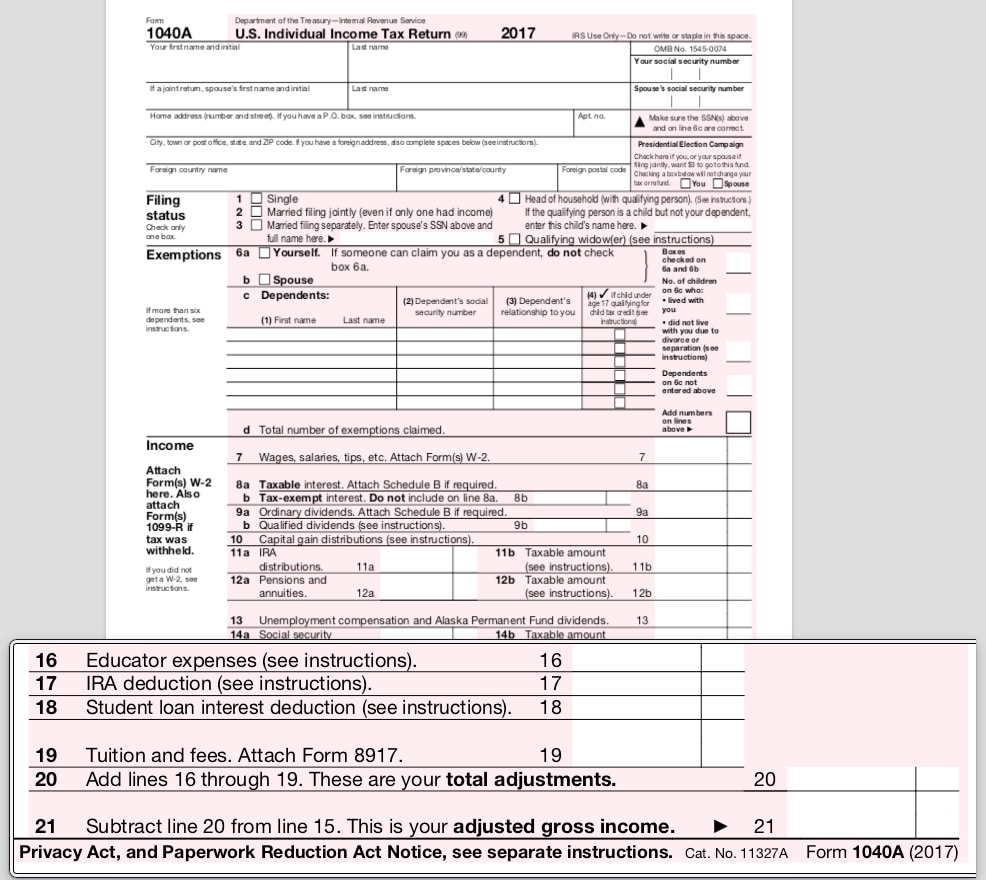

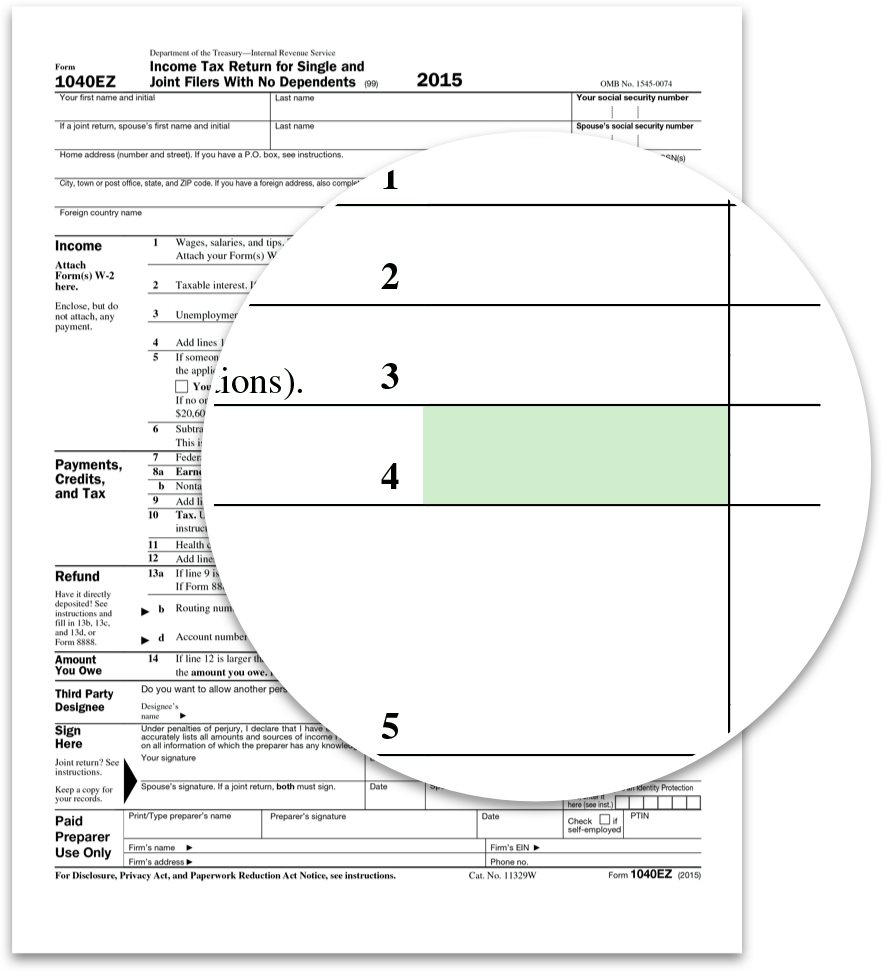

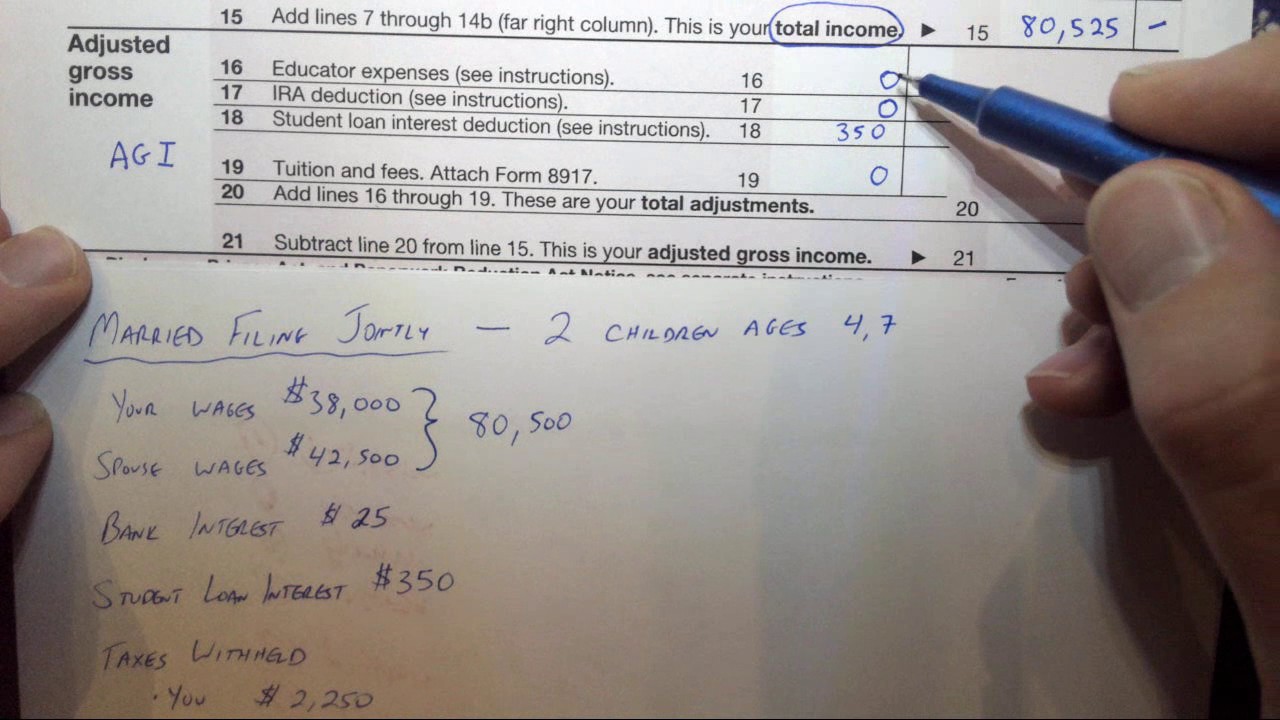

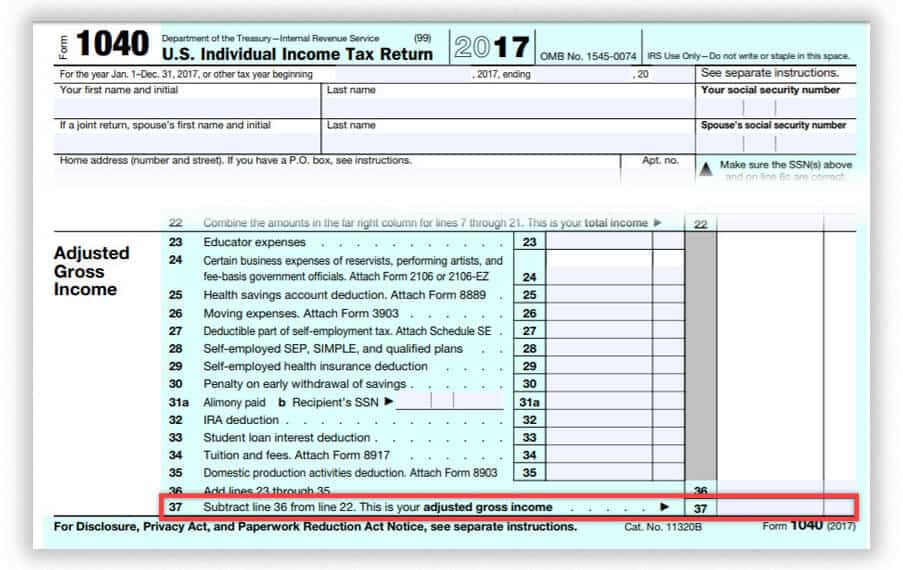

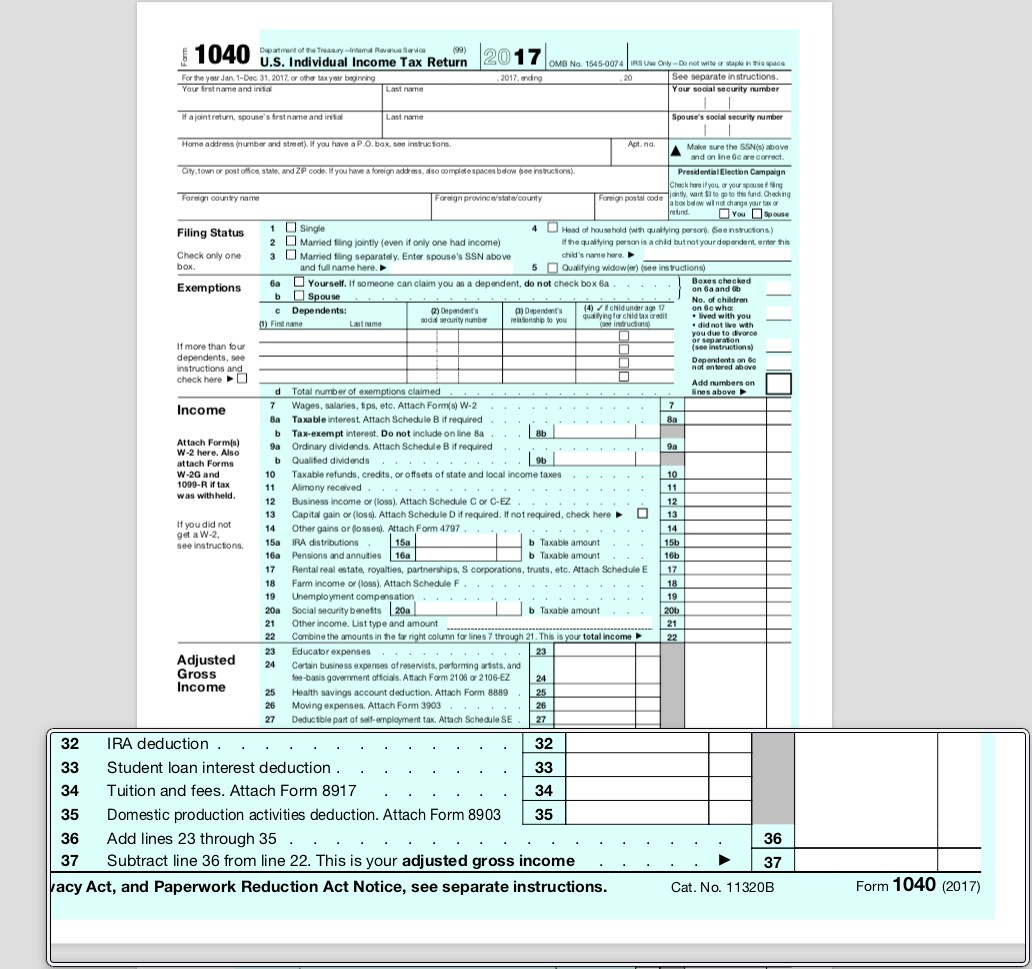

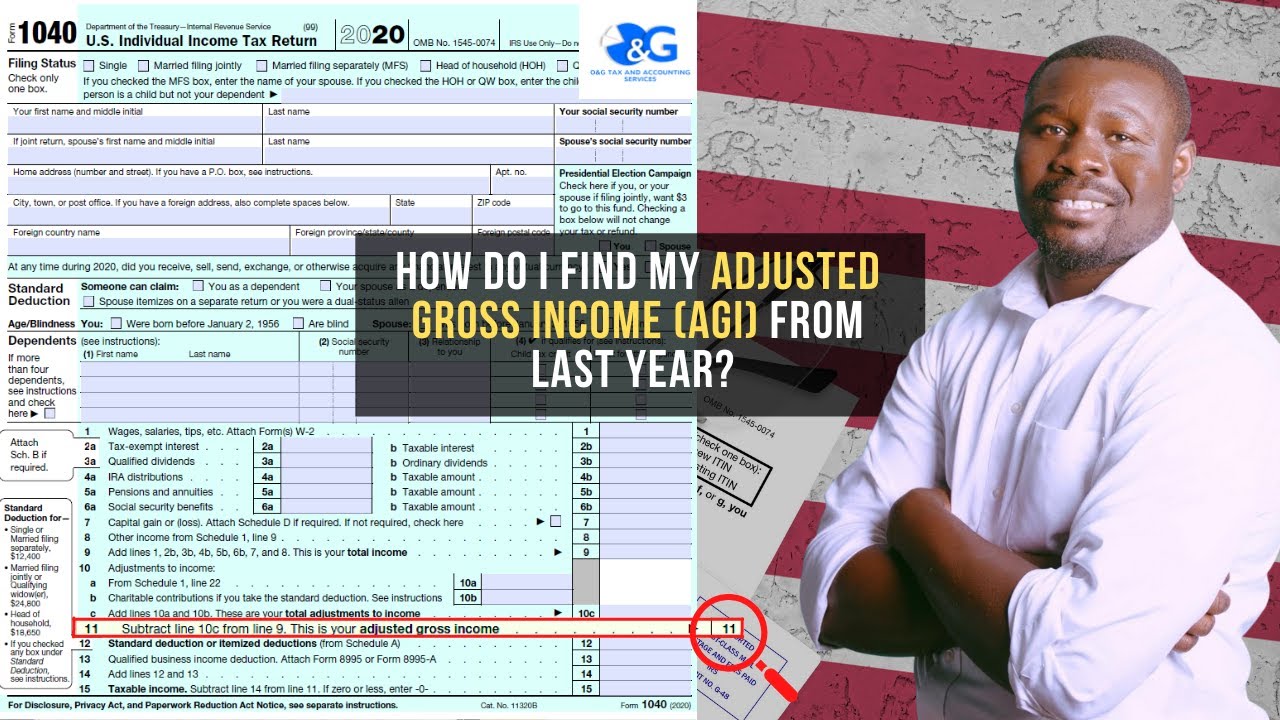

How do i find my agi for this year (2023)? Some forms allow you to take more adjustments to income, than others. The agi you should use to sign your current year return can be found on the following lines of your prior year return (round this.

If you don't have access to your return, you can request a copy from the irs online or by. We'll transfer your agi automatically when you file with the. Find your agi on last year’s tax return or in your online account.

You can view your prior year adjusted gross income (agi) online or by mail in your tax record. Learn how to calculate your agi by subtracting certain adjustments from your total income. Where do i find it?

So, if you cannot find your. Find out how to use $0, an ip pin, or. Use your online account to immediately view your agi on the.

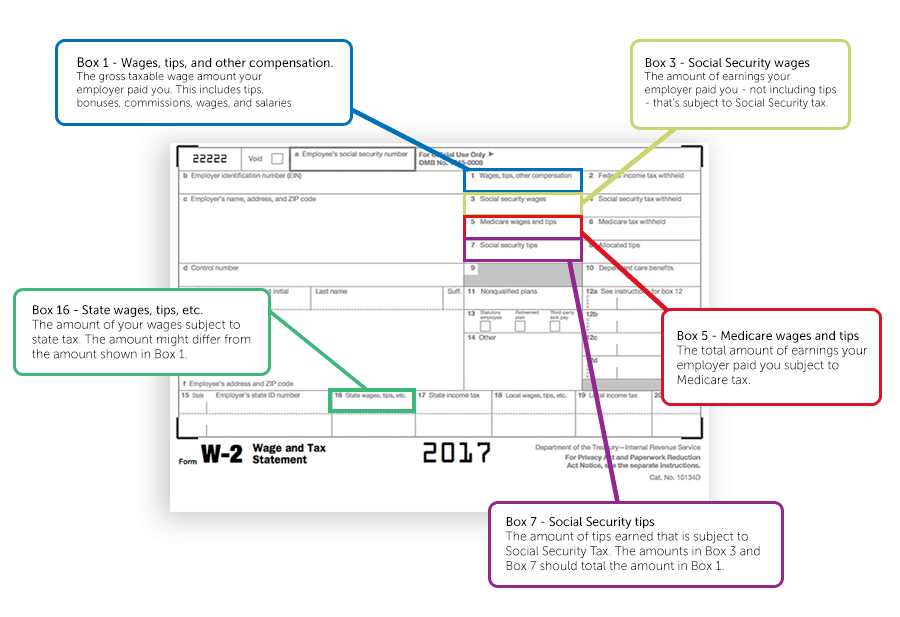

If you used online tax software to file last year, you. Tutorial on how to find previous year's agi in h&r block online 2024your agi is a crucial figure in tax filing, often required for verification purposes when. Overview the agi calculation depends on the tax return form you use;

Where is my adjusted gross income (agi) located on the 2019 return? How do i find last year's agi? Peter butler april 7, 2022 3:45 p.m.

This is because you may be eligible for a tax return if you paid income tax, or you may be eligible for certain credits. Solved • by turbotax • 7201 • updated november 22, 2023. But what if your 2020 tax return hasn't been processed yet?